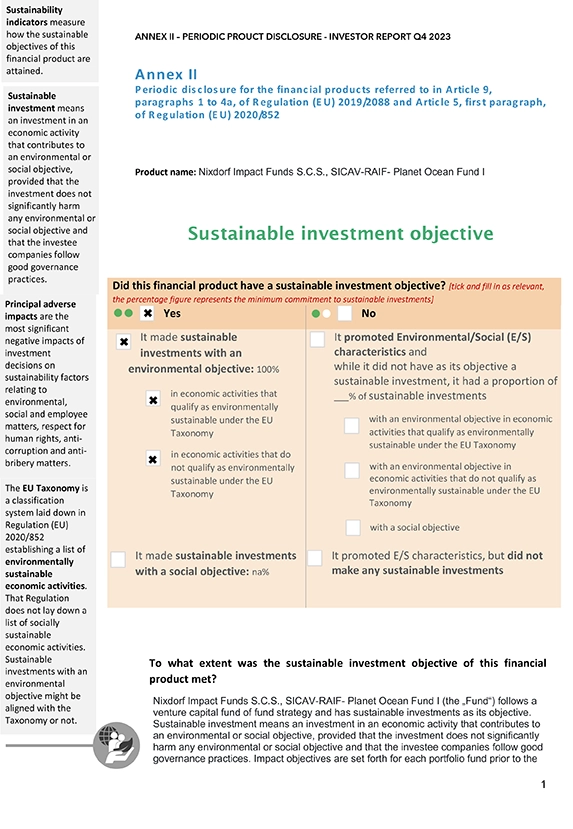

Disclosures according to the Sustainable Finance Disclosure Regulation (EU) 2019/2088

Under the Sustainable Finance Disclosure Regulation funds are classified according to their ESG commitment and positive contribution to environmental and social objectives.

Article 9 funds have a sustainable investment objective with a strong ESG focus. Planet Ocean Fund meets this requirements by investing in venture capital funds which (1) contribute significantly to an environmental objective; (2) do not harm environmental or social objectives; and (3) follow good governance practices.

Policy on integration of sustainability risks

Planet Ocean Fund takes sustainability risks into account in its investment making process. Sustainability risks are environmental, social or governance events or conditions that, if they occur, could cause an actual or a potential material negative effect on the value of the investments. As part of its standard procedure, Planet Ocean Fund conducts a Due Diligence prior to investing that includes an assessment of sustainability risks. The results of these assessments guide Planet Ocean Funds investment decisions. In its free discretion, Planet Ocean Fund may decide to make an investment even if sustainability risks have been determined. In such cases, Planet Ocean Fund may apply appropriate mitigation measures.

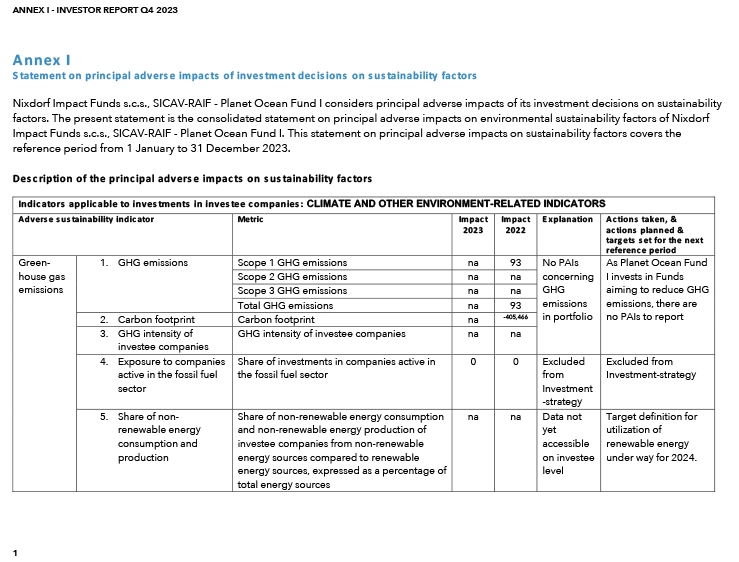

Principal adverse sustainability impact statement

Planet Ocean Fund considers principal adverse effects of investment decisions on sustainability factors. Sustainability factors are environmental, social and employee matters, respect for human rights, anti‐corruption and anti‐bribery matters. Planet Ocean Fund invests in venture capital funds trying to achieve a positive impact on planet earth, that contribute to significant improvements in at least one of the following key areas: GHG emissions, biodiversity loss, renewable energy, waste production, resource exploitation and/or circular economy. Prior to each investment, Planet Ocean Fund conducts an impact due diligence to assess the environmental impacts a target fund is going to have. This allows for detecting and quantifying principal adverse environmental effects.

As part of its due diligence Planet Ocean Fund also conducts a risk assessment regarding environmental, social and governance issues via a checklist. The results of this assessment are taken into account when taking investment decisions. In its free discretion, Planet Ocean Fund may decide to make an investment even if adverse impacts have been determined or are expected. In such case, Planet Ocean Fund may apply appropriate mitigation measures including but not limited to offering training and advice for portfolio funds to support their capacity to control, mitigate and/or reduce such adverse impacts in their portfolio companies. Planet Ocean Fund is not a member of international bodies or organizations or obliged under national or international conventions or standards to adhere to further specific requirements relating to ESG compliance.

Planet Ocean Funds remuneration policies are on a large part dependent on achieving positive impact and are thus consistent with the integration of sustainability risks.

Product related disclosure (EU SFDR Art. 9)

Summary

Nixdorf Impact Funds S.C.S., SICAV-RAIF- Planet Ocean Fund I (the „Fund“) follows a venture capital fund of fund strategy and has sustainable investments as its objective. Sustainable investment means an investment in an economic activity that contributes to an environmental or social objective, provided that the investment does not significantly harm any environmental or social objective and that the investee companies follow good governance practices. Impact objectives are set forth for each portfolio fund prior to the Fund’s investment. Planet Ocean Fund takes into consideration negative adverse impacts of the Fund’s investments.

No significant harm to the sustainable investment objective

The Fund’s investments not only avoid harm, but generate significant positive outcomes for planet Earth.

In order to exclude any possible adverse effects Planet Ocean Fund conducts an impact measurement at the asset level, periodically measuring a number of KPIs to assess the environmental impact of the investments. This allows for revealing and quantifying adverse environmental effects. Planet Ocean Fund also assesses potential adverse effects in regards to environmental, social and governance issues during its due diligence and takes the results into account in its investment decisions. The Fund`s risk management processes take into account such sustainability risks by way of identifying, mitigating or offsetting such risks early and effectively. For that purpose, a set of related questions has been integrated in the pre-investment Due Diligence questionnaire as well as in the post-investment monitoring and support processes.

Investment strategy

Planet Ocean Fund invests into early stage climate tech venture capital funds and helps to achieve UN SDG14 Life Below Water and the „Net Zero GHG Emissions“ target (SDG 13 Climate Action). Targte funds need to align to those targets or must be active in one of the following strategic impact fields:

NUTRITION

• alternative aquatic nutritional sources & plant (algae) based low GHG proteins

• precision mariculture and robotics & sustainable fishing

• food loss & waste reduction

ENERGY & SEQUESTRATION

• energy storage

• alternative fuels

• low GHG shipping

• oceanic carbon capturing, utilisation and storage

• GHG monitoring and management platforms

PLASTICS & DATA

• Low GHG plastics or plastic alternatives & reusables (circular economy)

• climate-, ocean- and earth data generation

The impact focus of Planet Ocean Fund is part of every step along the investment process and starts in target screening and pre selection according to impact criteria over the continuous monitoring of impact KPIs through the investments lifecyle as well as to an impact carry structure. Governance issues are being addressed as part of an ESG questionnaire during the Due Diligence.

Proportion of investments

The Fund will only invest in line with its investment strategy, which can be summarized as follows: investing in early stage (pre-seed. seed, series A) venture capital funds in Europe and Africa that have the potential to make a significant positive environmental impact globally.

Monitoring of sustainable investment objective

Planet Ocean Fund regularly monitors impact KPIs of investments. Wherever possible impact performance data is being gathered automatically and in real-time from the portfolio companies.The impact performance of the portfolio companies will be assessed by Planet Ocean Fund and information provided to the investors on a quarterly basis on a target fund level as well as on an overall portfolio performance. Impact KPIs monitored for each investment are:

#GHG reduction

GHG emissions (Scope 1,2 and 3) per year (aligned to 7% reduction trajectory of EU CTB)

GHGs smashed (cutted/removed) per year

# Ecosystematic ipmact (one or more of the following where applicable):

wildcatch reduced

bycatch reduced

sustainable proteins (plant based, alternative sources) produced

resource use (food loss)

resource use (energy consumed)

plastic waste reduced

marine plastic recycled

Ecoystem services provided/improved/restored

Length of coastline restored

development of alpha-biodiversity (eDNA approach, Shannon) in impacted regions

# Fluctuation of employees p.a.

# Measures taken to enforce genderequality and diversity througghout the value chain

# Regional and Industry-adapted fair salary

# full adherence to applicable tax-regulations (corporate governance) is prooven an a yearly base

Planet Ocean Fund strives to reduce GHG emissions and increase sinks in line with the objectives of the Paris Agreement. Its investments are supporting green or sustainable activities and the climate impact of those investments improve year after year. Following the mission to support the transition to a global economy that operates within the planetary boundaries and utilizes the world’s oceans wisely and sustainable, we will not invest in companies that are not part of the solution to the climate or biodiversity crisis or harm the oceans in any way.

Do not hesitate to contact Planet Ocean Fund for further queries at office@planetocean.fund

Send download link to:

Send download link to:

Input your search keywords and press Enter.